Planned Giving

Gifts of Life Insurance

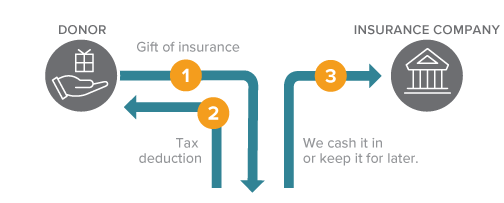

Make a significant gift to Marmion even without a large estate. Here's how you can leverage your dollars for a larger gift.

How It Works

- You transfer ownership of a paid-up life insurance policy to Marmion.

- Marmion elects to cash in the policy now or hold it.

- Consider naming Marmion in your long-term plans. It's simple.

Benefits

- Make a gift using an asset that you and your family no longer need.

- Receive an income tax deduction equal to the cash surrender value of the policy.

- You may be able to use the cash value of your policy to fund a gift that delivers income, such as a deferred gift annuity.

Next

- Frequently asked questions on gifts of life insurance.

- Contact us so we can assist you through every step.

Ways to Give

Giving Tuesday

At Marmion Academy, #GivingTuesday is an opportunity to direct unrestricted support to the Marmion Fund. These short, high-energy campaigns also help Marmion engage alumni, families, and new donors and can unlock matching grants or local incentive grants when participation goals are met.

Ways to Give

Salute to Youth

Salute to Youth is an annual fundraising event, hosted by the Marmion Benedictines and Board of Trustees. This cherished tradition brings together parents, alumni, and friends of Marmion for an evening that celebrates the senior class while raising vital support for the school. Guests enjoy a cocktail reception, gourmet dinner, and live music in an elegant setting.

To learn more about the event please contact, Kathleen Hausmann, Executive Director of Advancement, at khausmann@marmion.org.

Ways to Give

Day of Giving

Marmion Academy’s annual Day of Giving is a time for our community to unite in support of our mission to form young men and women of faith, character, and leadership. Every gift makes a lasting impact, supporting scholarships, academic and extracurricular programs, campus resources, and leadership opportunities while carrying our mission forward for the next generation.

Advancement

Meet the Advancement Team

Our Advancement Team is here to connect your generosity with the mission of Marmion. Their goal is to help ensure every gift makes a lasting impact for Marmion Abbey, Marmion Academy, and Marmion’s Guatemala Mission.

Kathleen Hausmann

Executive Director of Advancement

khausmann@marmion.org

(630) 966-7672

Fr. Charles Reichenbacher, OSB '59

Director of Planned Giving

creichenbacher@marmion.org

(630) 897-6936

Maria Asher

Assoc. Director of Major Gifts

masher@marmion.org

(630) 966-7642

Tyler Friel '11

Director of Alumni

tfriel@marmion.org

(630) 966-7665

Terri Rios

Creative Director

trios@marmion.org

(630) 966-7666

Jessica Brown

Events Manager

jbrown@marmion.org

(630) 966-7654

Rhonda Cousins

Advancement Office Manager

rcousins@marmion.org

(630) 966-7628

Sheila Bangs

Database Specialist

sbangs@marmion.org

(630) 966-7644